Representatives from Sierra Leone’s leading law firms gathered on Tuesday 5 November to discuss steps the legal sector can take to support inbound international investment.

The roundtable was part of a programme of activities organised by the Africa Resilience Investment Accelerator (ARIA) and Invest Salone, for a delegation of international investors visiting Sierra Leone to explore opportunities in the infrastructure and sustainable tourism sectors. It was co-hosted by leading international law firm Herbert Smith Freehills and the UK Sierra Leone Pro Bono Network.

Invest Salone’s Team Leader, Chukwu-Emeka Chikezie chaired the event. He explained the objective was to identify and share actionable strategies and solutions to help bolster Sierra Leone’s legal sector’s capacity to attract and manage international investments. “We hope that we can leave this evening’s discussion with actionable strategies and solutions,” he said.

He was followed by Alex Kucharski, British International Investment’s (BII) ARIA Lead for West Africa, who briefed participants on the ARIA country visit. Alex said that a healthy pipeline of investment had been generated by three previous ARIA delegations to Sierra Leone, with more transactions expected. “High quality local legal advice will be increasingly important, especially as interest from development finance institutions builds up with each successive visit to the country,” he added.

The discussion covered a wide range of topics, including opportunities to represent investors; how to link investors with lawyers on the ground; collaborations between investors and the private practice legal sector to encourage a more enabling business environment; the role of mediation and conciliation; capacity building; and structural or practical hurdles to delivering investment from a legal perspective.

Christina Clark-Lowes, Investment Lead with Invest Salone said that high transaction costs relative to the investment size often deterred potential investors. She explained that de-risking instruments such as Invest Salone’s PROSPER Salone grant or Investment Readiness Technical Assistance Facility were designed to support investors and investees to reduce transaction costs and risk perception.

“Sierra Leone’s legal community already has great capacity and experience working with investors and we are keen to work with them to further strengthen the ecosystem, particularly around environmental, social and governance issues which have been flagged by several participants as an important area to strengthen further, as ESG [environmental, social and governance] is a key requirement for responsible investors including development finance institutions,” she concluded.

About ARIA

The Africa Resilience Investment Accelerator (ARIA) is an initiative founded by BII and FMO, the Dutch entrepreneurial development bank, which aims to unlock investment in frontier markets across Africa. It currently operates in Sierra Leone, Liberia, Benin, DRC and Ethiopia. ARIA supports BII and FMO as well as other development finance institutions to increase investment in the markets of focus. It works closely with companies on the ground to enable them to become investment ready, helps build investment ecosystems, and engages governments and donors. In Sierra Leone, ARIA has a partnership with the British High Commission and has developed a number of investment opportunities with some in the pipeline for development finance institutions.

About Invest Salone

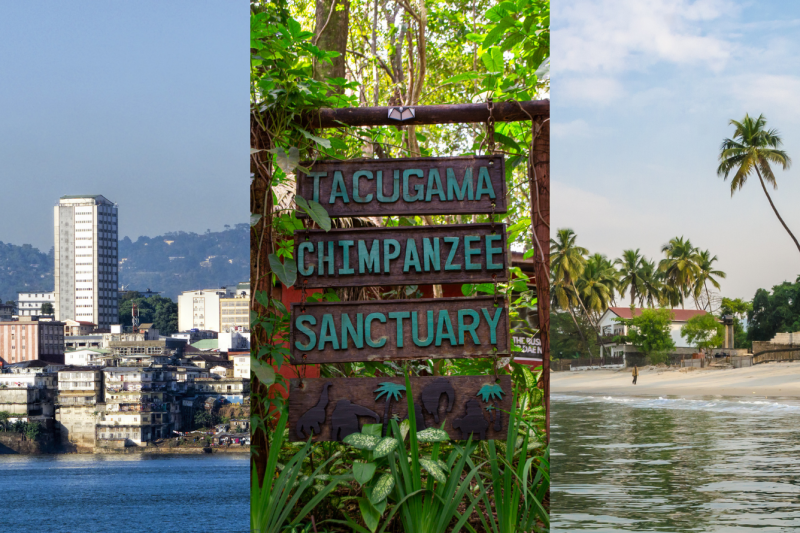

Invest Salone is a UK funded private sector development programme which works to encourage investment, generate exports, create jobs and diversify key sectors in Sierra Leone.