Invest Salone, the UK aid-funded private-sector development initiative, announced on 15 May 2023 that it has awarded funding to three innovative investors who aim to mitigate the adverse impact of climate change in Sierra Leone.

The funding has been awarded through PROSPER Salone, a grant-matching facility for domestic and international investors looking to invest in Sierra Leone, one of the most vulnerable countries to climate change in West Africa.

Pooja Melwani, consultant with Invest Salone, says: “Sierra Leone is among the 10 percent of countries most vulnerable to the negative impact of climate change. The need for innovative solutions in the areas of climate change mitigation and adaptation is an opportunity for companies to develop new products. Funding provided under PROSPER Salone’s climate window grant scheme is intended to pave the way for increased private-sector investment to address climate change in Sierra Leone, by helping to de-risk investments for potential investors.”

The three new grantees are:

Solon Capital Partners: Founded in Sierra Leone in 2010, Freetown-based Solon has co-founded West Africa Blue, a developer of community-centric blue carbon projects in West Africa with a flagship project in the Sherbro River Estuary region of Sierra Leone. West Africa Blue’s projects target climate change mitigation and adaptation through mangrove conservation and restoration in addition to community income diversification initiatives. Solon has been awarded a PROSPER Salone grant to partially fund a full feasibility assessment for West Africa Blue that will help prove the financial viability of the concept and attract further investment.

Truestone Impact Investment Management: With a 10-year track record of impact investments in Sierra Leone, Truestone has been increasingly deploying capital towards tackling climate change risks. PROSPER Salone funding will allow Truestone to introduce carbon tracking and mitigation strategies across its portfolio, adjust its fundraising approach to target larger-scale, climate-focussed funding sources, and scale up new greenfield agri-finance products.

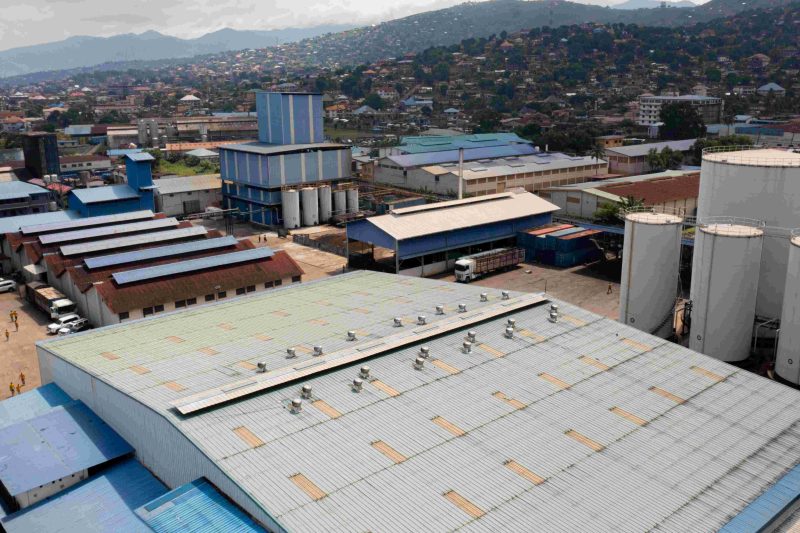

Incluvest: Incluvest makes equity investments in agribusinesses or businesses linked with agricultural value chains that have inclusive business models. Incluvest intends to work with investees and the smallholder farmers operating in the investees’ supply chains to support them in adopting climate-smart practices. There are relatively few investment-ready firms in Sierra Leone’s agro-processing sector, and they face challenges in accessing finance on affordable terms. PROSPER Salone funding will help Incluvest develop a pipeline of investible businesses and grow their portfolio in Sierra Leone.

PROSPER Salone works by co-sharing the costs of activities that will reduce the risks of market entry, such as scoping trips, feasibility and viability studies, developing pipelines of investible businesses and conducting due diligence.

Melwani says: “Investors interested in the Sierra Leonean market typically face several barriers to entry. This leads to higher-than-average transaction costs. These include a lack of information on comparative returns, high costs and efforts for pipeline development, a data-poor environment for market feasibility, a lack of understanding around the legal and accounting environment, and no transparency or visibility in the regulatory environment. PROSPER Salone supports activities that investors would not be prepared to otherwise pursue due to the commercial risks and expenses.”

PROSPER Salone offers grants of between £5,000 and £350,000 and requires that investors provide matching funds (in kind or cash) equivalent to at least 20–30% of the total cost of the supported activity.

The scheme has proved successful in encouraging investment into Sierra Leone, with previous grantees successfully mobilising investments worth US$16.9 million into seven Sierra Leonean companies.

Lorisa Canillas, Senior Investment Manager at Cordaid Investment Management, a previous grantee, says: “Under the PROSPER Salone grant facility, Cordaid Investment Management (CIM) collaborated with Invest Salone in growing the number of investment-ready firms under the West Africa Bright Future Fund. Sierra Leone is one of the focus countries of the fund managed by CIM, which seeks to invest in economic sectors that will create jobs for women and youth and are relevant to combatting climate change. The PROSPER Salone initiative helps international investors overcome the high cost and complexity of due diligence. It enables the provision of technical assistance to firms to mitigate investment risks or enhance their social impact. The collaboration has deepened our understanding of the market and has increased our confidence to move forward in such a challenging market.”

For more information, please visit the Invest Salone website or view our PROSPER Salone infographic.